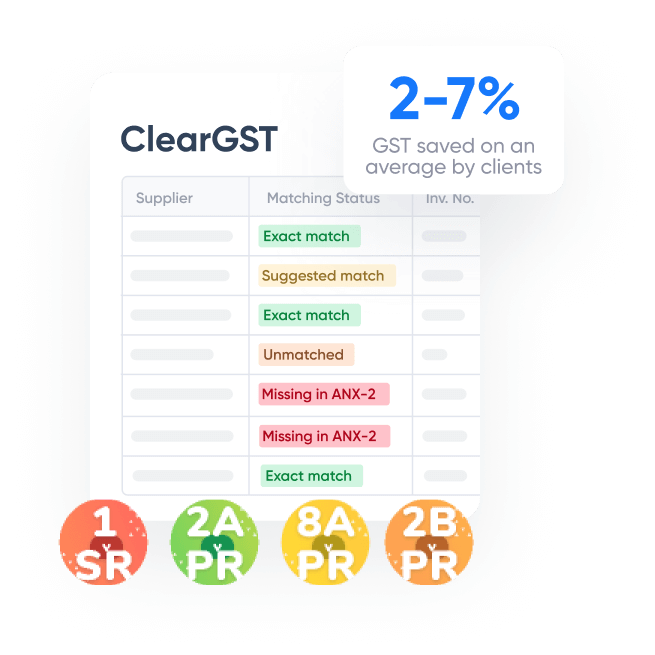

Upto 7% tax savings

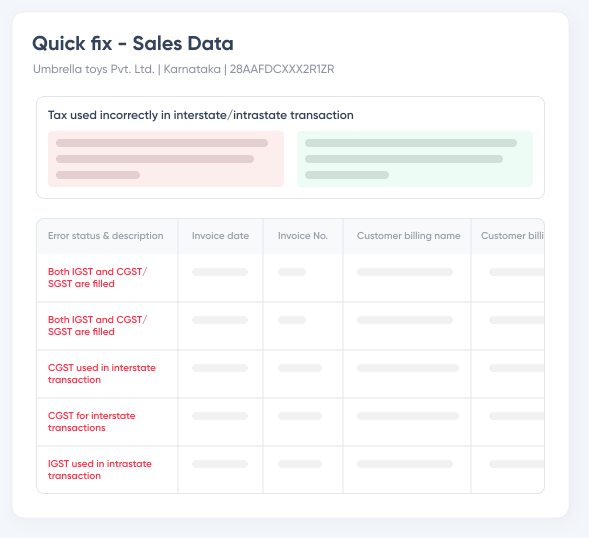

Claim 100% ITC and save an average of 4% GST everytime.

All filings, G1 to G9

We are a SSL compliant & SOC 2 certified GST Suvidha Provider

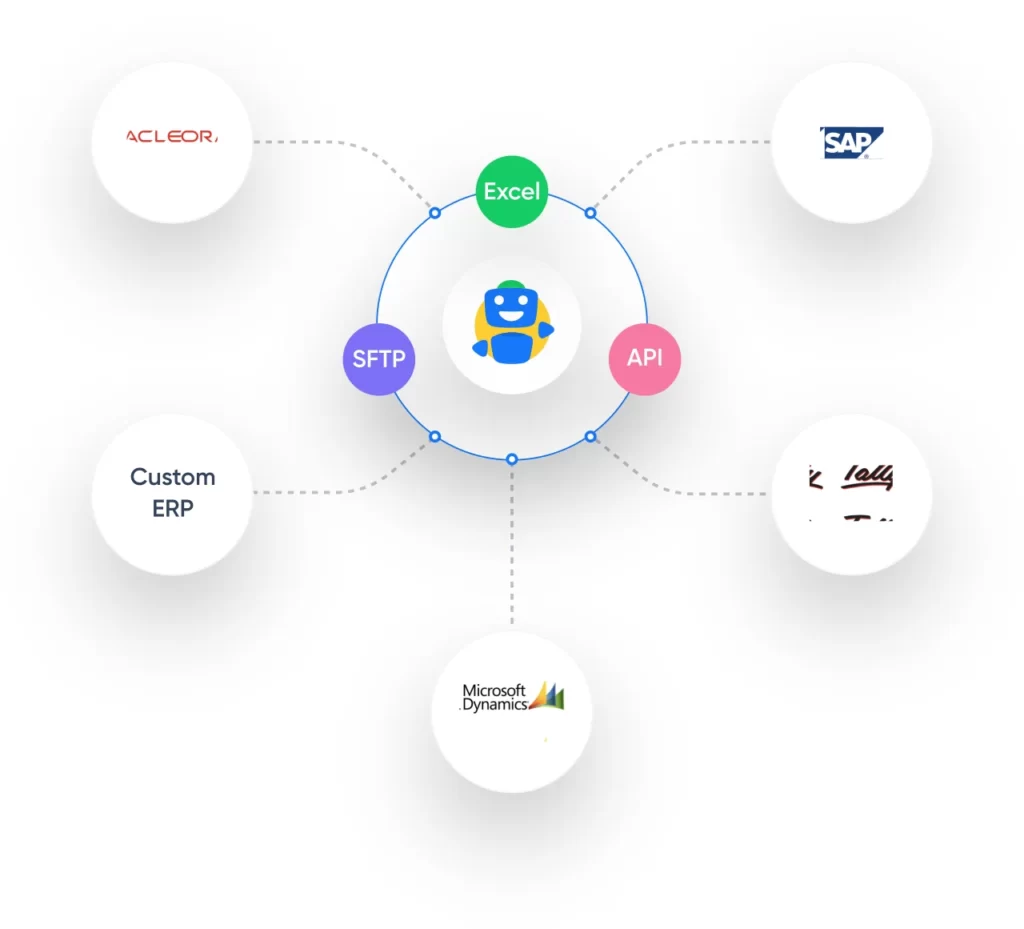

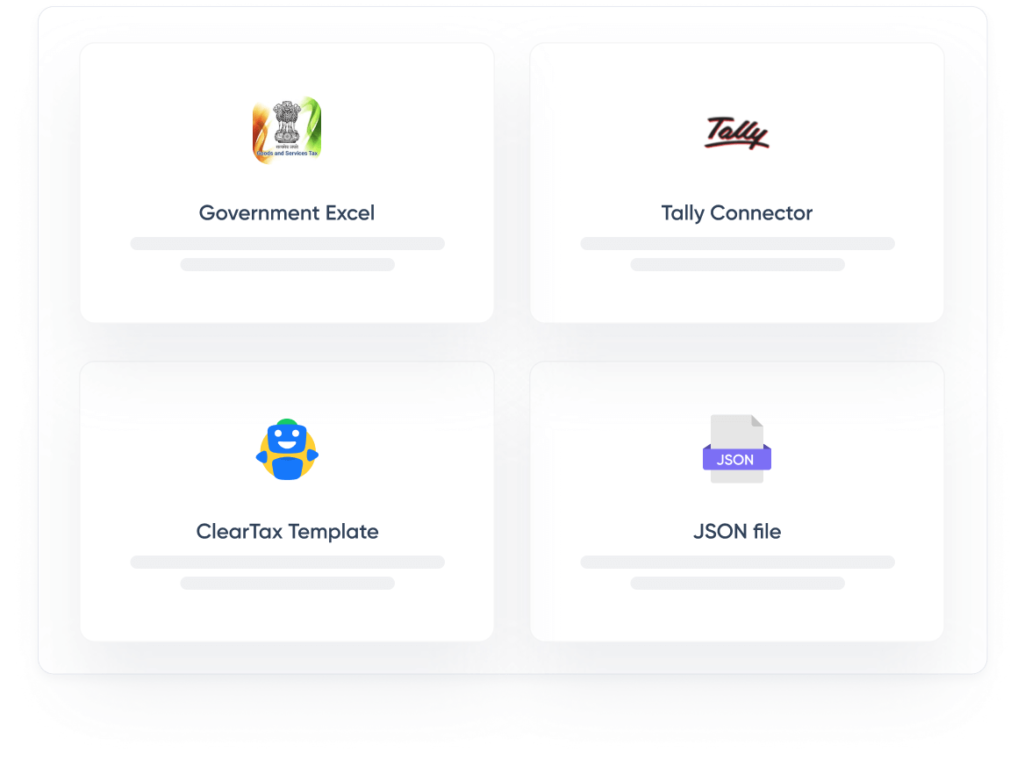

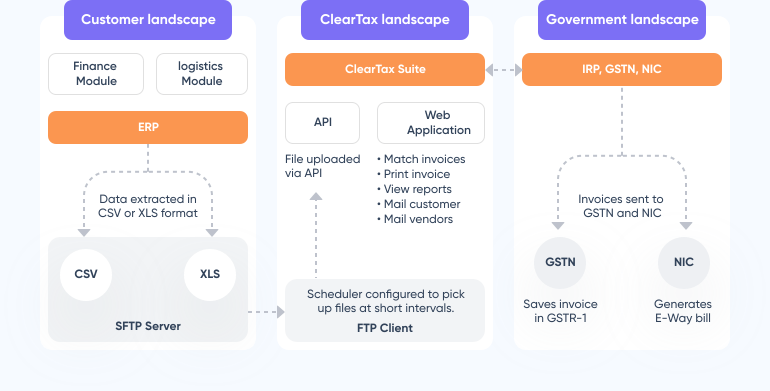

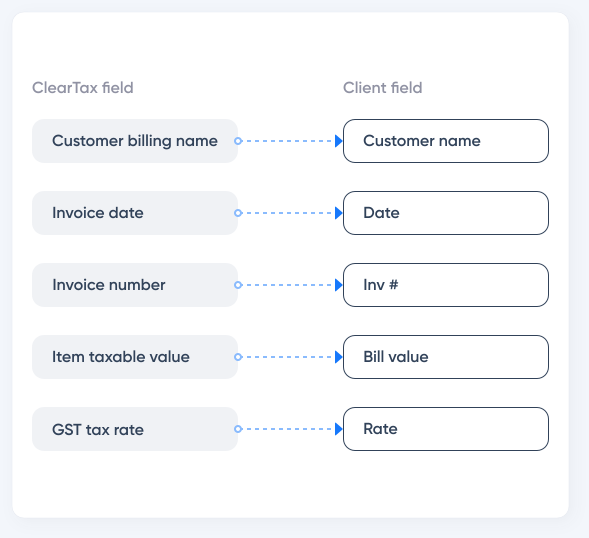

Easy to connect

Connect with 100s of ERPs, import data error-free

3x faster experience

Save 2 man-days per GSTIN every month